how much does cash app take out for instant deposit

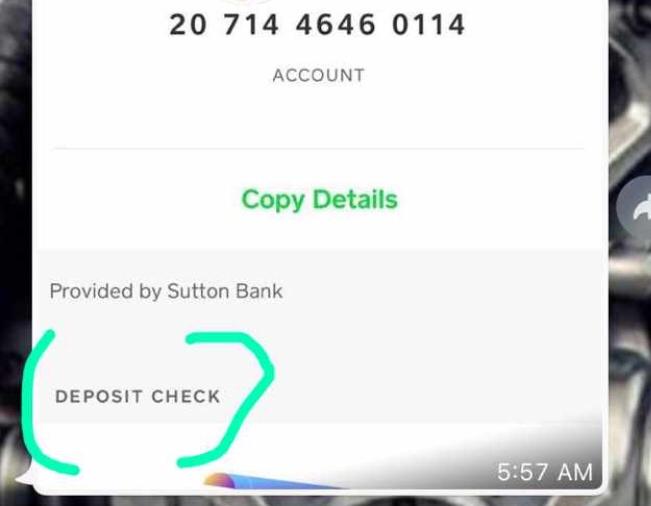

If you dont have this option it means your Cash App doesnt yet have the check depositing functionality so youll be unable to deposit a check using Cash App. Cash App Fee At a Glance.

Cashapp Transfers Straight To Your Cash App Account

So for receiving or sending 20 with a debit card you dont have to pay any fee.

. Now you have. In this post we will talk more about Cash App ATM fee withdrawal limits and if it is possible to cash out without any cost. With a cash app instant transfer your money will be transferred instantly.

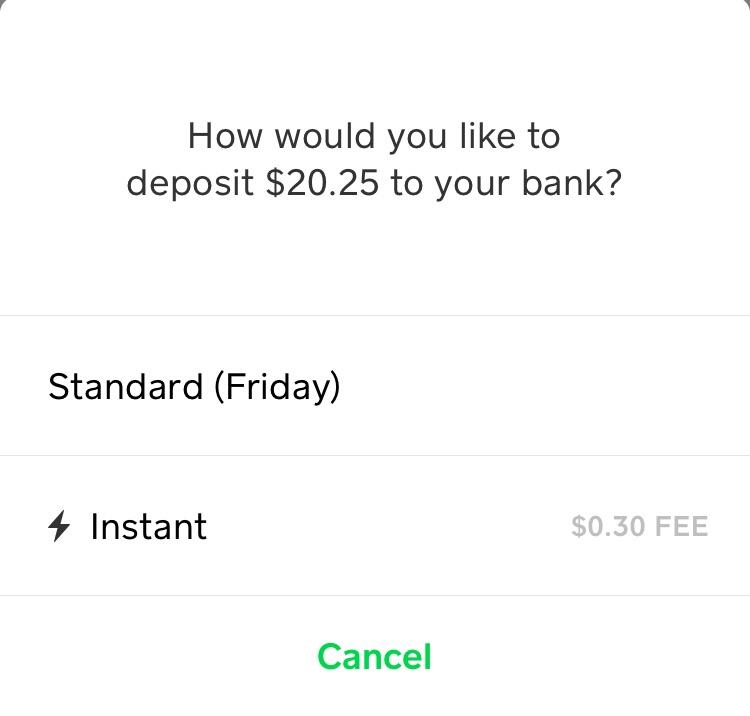

The other option Cash App offers is Instant As the name suggests transferring with Instant makes your money available instantly. We dont work with all the same transaction networks as these third-parties and therefore transfers may take longer than expected but never more than 13 business days. Instant Deposits are subject to a 05 -175 fee with a minimum fee of 025 and arrive instantly to your debit card.

What Im saying is i typically only get charged 3-4 to do an instant deposit but my mom got charged 7 for less then what i usually receive. Depositing checks via the Cash App is easy and includes the following steps. Users who cash out with Instant can expect to pay between 05 and 175 percent of the funds theyre cashing out with a minimum fee of 025.

Instant deposits cost 15 and a minimum deposit fee of 025. How Much Does Cash App Charge For 100 Instant Deposit. Lastly take a photo of the front and back of the check with your phones camera.

This is a rather. To deposit a check using Cash App. The 7-day and 30-day limits are based on a rolling time frame.

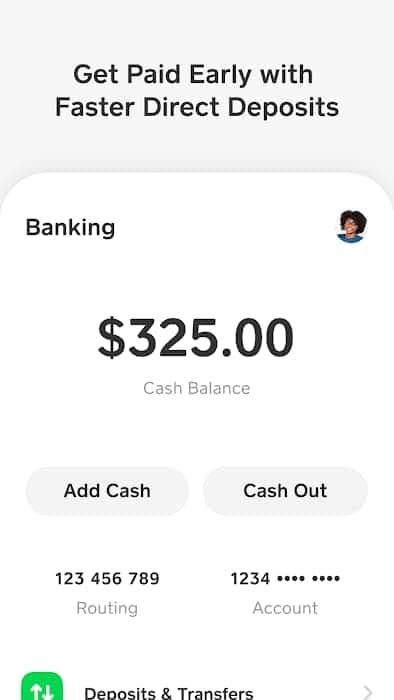

The apps analyze your banking information to offer you a small cash advance loan until your next check arrives. Cash out is a facility on cash app where you can withdraw money from your cash app account to bank account or debit card. Cash App offers standard deposits to your bank account and Instant Deposits to your linked debit card.

It costs 3 of the total amount transferred. Scroll down and tap on the to deposit a check option. Cashapp is free and doesnt charge sending fee on any of their transactions.

Cash App direct deposits hit your bank account at different times depending on what time you initiated the transfer and how much time it takes your bank to process transactions. Tap on your balance in Cash App. If you are sending money via a credit card linked to your Cash App a 3 fee will be added to the total.

After that youll be asked to enter an amount of the check you are depositing. Cash App direct deposits are made available as quickly as possible once theyre sent. While Cash App itself doesnt mention a specific time of the day on their website it takes about 1-5 days for the funds to hit your account.

Cash out is a facility on cash app where you can withdraw money from your cash app account to bank account or debit card. With Paper Money deposits you can deposit up to 1000 per rolling 7 days and 4000 per rolling 30 days. However if you use a credit card to send you must pay 060 and to receive with an instant deposit you have to pay 30.

In cash app instant deposits cost 15 of the total amount. If you run into a deposit limit well send you a notification with more information. If cash app cant verify your id it might require additional information.

Typically Cash App deposits hit your account around 1130 am CST Central Standard Time when you initiated the transfer. No fee if you choose a standard money transfer method. Cash App ATM withdrawals would cost you 2 fee unless you make 300 deposit in your account every month.

Also the funds can land in your account up to 2 days early compared to many banks. Cash App Deposit Wasnt Instant When transferring money into your Point account from third-party apps instant doesnt always mean immediately. Tap on your balance in the top left corner of Cash App.

However it also comes with a small fee. If you are sending money via a credit card linked to your Cash App a 3 fee will be added to the total. How much does cash app take out for instant deposit.

Cash App Support Cash Out Speed Options. An Instant Transfer from your Cash App account to your associated debit card likewise costs 15. So sending someone 100 will actually cost you 103.

Weekends and holidays can delay this further. Transactions must be a minimum of 5 and cannot exceed 500 per deposit. Send 5 to any cash app user to get the 5 bonus from cash app.

So sending someone 100 will actually cost. Money transfer via Credit Card. Standard deposits are free and arrive within 1-3 business days.

The cash app doesn t charge a fee to send request or receive personal payments from a debit card or a bank account or for a standard deposit. On the following screen scroll down and tap on the the option to deposit a check. Cash app charges 15 minimum 025 for each instant deposit.

It charges a fee of 2 to 3 typically. Moreover the limit for the cash out is set at 1000 per dayand 310 per transaction in one day. Heres when your Cash App will charge you a fee.

How To Add Money To Your Cash App Or Cash Card

How To Use Cash App Direct Deposit

/Cash_App_01-c7abb9356f1643a8bdb913034c53147d.jpg)

How To Put Money On A Cash App Card

How To Direct Deposit On Cash App Step By Step

Cash App Limit 2022 Daily Weekly Monthly Transaction Limits

Cash App Instant Deposit How To Change Cash App To Instant Deposit

2022 Cash App Fee Calculator Square Cash App Instant Deposit Fee Calculator

Cash App Instant Deposit Not Showing Up What To Do

2022 Cash App Fee Calculator Square Cash App Instant Deposit Fee Calculator

How To Get Free Money On Cash App Gobankingrates

How To Direct Deposit On Cash App Step By Step

Cash App Vs Venmo Which Is For You

Cash App Mobile Check Deposit What Is It How Does It Work Cash App

Cashapp Not Working Try These Fixes

How Does Mobile Check Capture Cash App Work Cash App Mobile Check Deposit

Cash App Instant Deposit How To Change Cash App To Instant Deposit